Analysis of the Cannabis Pre-Roll Market

Pre-Roll Market Size

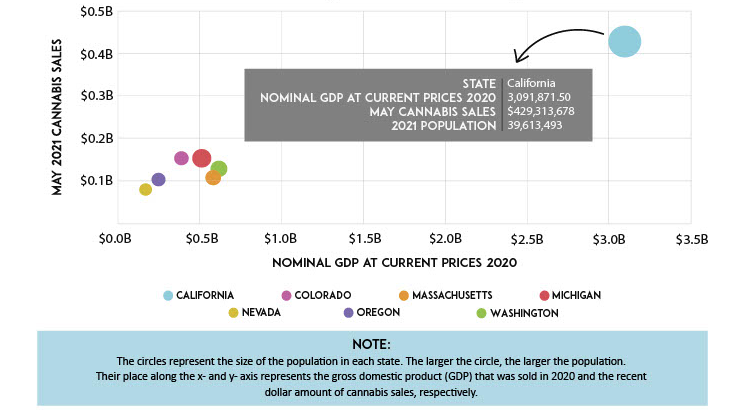

Additional data from Headset* provides more insight into the current state of the industry. It’s clear that certain factors associated with differences in sales volume between states can and should be examined.

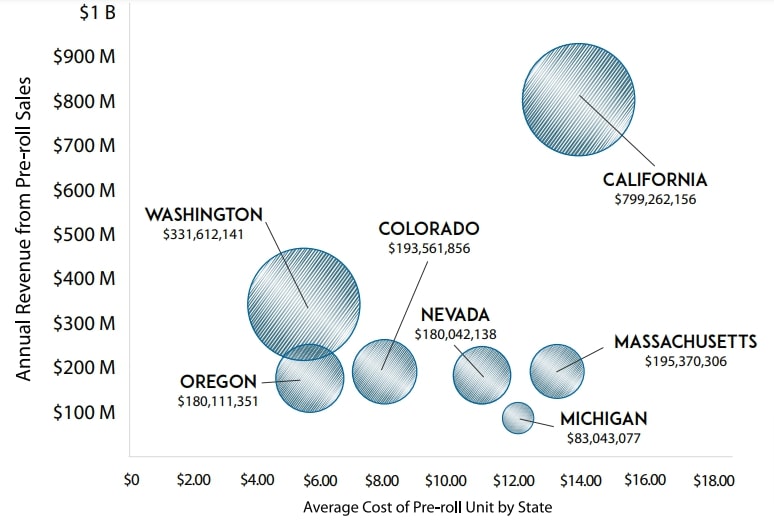

The above chart outlines the correlation between average price per unit and overall market sales data. Based on this chart, there does not seem to be a correlation between annual pre-roll sales and unit price. When viewing the results of the correlation, there does not seem to be a direct relation between annual pre-roll sales and unit price. California and Massachusetts, where the unit price is the highest out of any states, also boast the first and third largest markets by sales, respectively. Washington on the other hand has the second largest pre-roll market and has the lowest average price per pre-roll unit.