As we get closer to federal legalization, 2021 will contain the building blocks for a successful national cannabinoid industry. Here, we break down what we’ve heard, what we’ve read, and what we hypothesize will happen in the upcoming year.

2021 is the year of M&As.

With the varying regulations across stateliness and the challenges that come with them, domestic brands have yet to claim a dominant share of the national market. As industry titans like Columbia Care, Curaleaf, and Trulieve watch the states get closer to federal legalization, they’ve doubled down on their efforts to properly position themselves in the market, develop a greater degree of product consistency, and push for more widespread brand recognition. This is being done through M&As. In late November, the Subversive Capital Acquisition Corp. announced that they were in the process of purchasing Caliva and Left Coast Ventures and that the deal would be completed by January 2021. This is simply the first of many to come. Expect to see MSOs paying premium prices to scoop up businesses that have sizable and hard-won brand recognition and loyalty.

Prepare for Amazon and national brands.

This future widening of the distribution network brings up another point: national brands. Right now, can you think of the #1 brand that dominates the market share nationwide? Trick question – it’s impossible! Each state has its own most popular brand, but none are nationwide premier brands. 2021 will change this and we have a few ideas on who this will be and why.

Nielsen predicted that Amazon will be entering the market soon and we believe them. The massive logistics company can help alleviate the current distribution challenges, but whenever outside kingpins enter the space, it’s likely they’ll bring in some other game-changing pros and cons.

CBD products become normalized.

Between Lord Jones’ success in global beauty store, Sephora, and Nielsen’s recent prediction that conglomerate Amazon will enter the CBD space, it’s clear that major established names will continue to enter the cannabinoid space. The billion dollar predictions and growing number of CBD regulations has created an environment that more established retailers feel safe entering into, so in 2021, expect to see your favorite companies dipping a toe into the cannabinoid pond.

Stigma no more.

With many states and cities hurting as the true economic impact of COVID begins to hit, government officials will call for financial reform. In comes the cannabinoid industry, a potential goldmine of tax revenue, job opportunities, and unfettered economic growth. In 2021, cannabis (and, by extension, cannabinoids) will shed the last of their remaining stigma and be embraced as a viable, safe industry.

2021 will be a major year for regulations.

US MSOs will have to transition to the same GMP and food safe regulations imposed on Canadian LPs. Be proactive and start working toward these now. It takes a sizable amount of resources to ensure that you’re meeting these standards and when (not if) this is mandatory, it will be a mad dash to the finish line. Avoid the rush and start as soon as possible.

Influencer Partnerships will emerge.

Equity partnerships with influencers is the best growth hacker, especially in an industry where traditional advertising has been barred. Big brands like Cholula, Fitness Performance Tech, and Body Armor have always been on the hunt for the next best partnership opportunities, and as athletes begin to open their own dispensaries and cannabinoid brands, the public will start to see synergistic marketing efforts between the two. Expect this to be a common occurrence in the space as regulations continue to soften and the big industry players duke it out to see who will be the top dog.

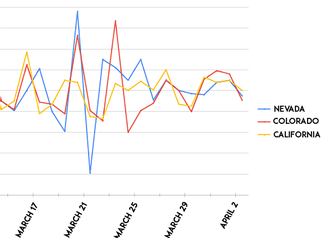

Pricing Will Start Trending Down.

The increase in clone pricing could be a sign that companies are turning to indoor hemp cultivation for smokable flower where the main method for cultivation relies on clones instead of seeds. Furthermore, the decrease in overall licensed and planted acres of hemp could be another signal that indoor cultivation is providing a viable product for the market. As such, prices are significantly down when compared to a year ago.

CBD isolate prices also continue to trend down, and this could potentially open opportunities for new consumer adoption. Lower COGS means lower consumer prices which means a new pricing tier, and this will allow a larger number of people to try CBD products.