Join the others who are receiving high-signal, data-driven analysis to be in front of their peers in the cannabinoid space! If you have found value in our insights please share this with another canna-curious individual to grow the revolution!

Please note this is part of our Monthly Playbook. If you would like to read the entire Monthly Playbook you can sign up here. The library can be found here

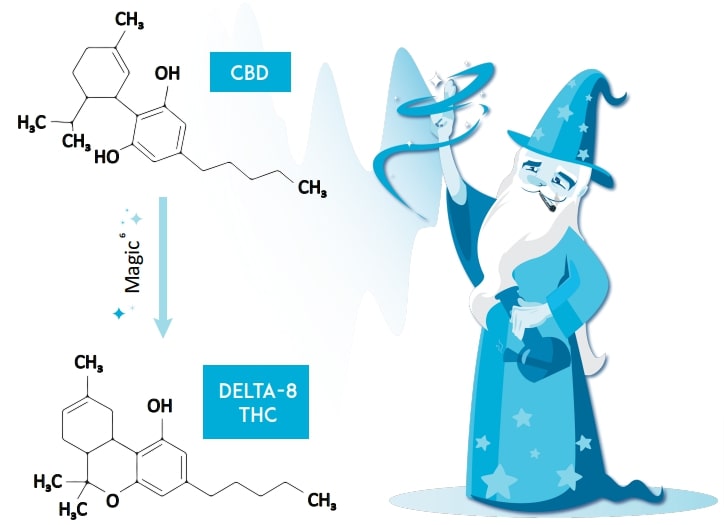

What Is The Real Cost Of Converting Your CBD To Delta-8- THC?

Often derivative products are taken at face value when being compared. Currently, this is the case when we speak with operators about CBD and Delta-8 THC. The decision-making process always centers around comparing the price of 1 kg of CBD isolate (~$533.00 / kg) to the price of 1 kg of CBG isolate (~$1,150.00 / kg), which at the surface shows the potential to double the gross revenue.

Once you dive into the hard costs of converting your CBD inventory to Delta-8, the story changes dramatically. Below, we go through a calculation that takes into consideration a variety of variables when calculating the costs of converting CBD. The fixed costs in this calculation are based on conversations we had with an R&D research chemist working at a licensed facility in Colorado.

What Is The Real Cost Of Converting Your CBD To Delta-8?

Based on our calculations, there’s still room for Delta-8’s price per kilogram to drop before the conversion becomes unprofitable. Our model suggests that, on this scale, the breakeven price per kilogram is around ~$923.00. Based on our forecast published in last month’s report, this could happen as early as May of this year. We advise our clients not to keep large inventories of Delta-8 in house due to the current Delta-8 pricing volatility.

| Input Categories | Assumptions | |||||

|---|---|---|---|---|---|---|

| CBD quantity (kg) | 10 | |||||

| Market value of CBD isolate | $ 533.00 | |||||

| Total cost of CBD | $ 5,330.00 | |||||

| Solvent quantity (Liters) | 15 | |||||

| Total estimated solvent cost | $ 1,400.00 | |||||

| Catalyst quantity (grams) | 50 | |||||

| Total estimated catalyst cost | $ 50.00 | |||||

| Total estimated labor cost* | $ 500.00 | |||||

| Total analytical testing cost (QA / QC) | $ 300.00 | |||||

NoteS:

*Labor cost is estimated based on 20 hours

of labor @ $25.00/hr

**Conversion yield is calculated after conversion,

work up, and purification to final product.

| OUTPUT Categories | Assumptions | ||||

|---|---|---|---|---|---|

| Conversion yield* | 85% | ||||

| Delta-8 THC quantity (kg) | 8.5 | ||||

| Market value of Delta-8 THC / kg | $1,150.00 | ||||

| Potential Revenue Estimated Profit |

$ 9,775.00 $ 2,195.00 |

Total Input Cost = ( Cost of CBD + Cost of Solvent + Cost of Catalyst + Labor + Analytical Testing )

Potential Revenue=( (Percent Yield from Reaction * Input Quantity of CBD) * Delta-8 Market Value )

Estimated Profit = Revenue – Input Cost