Join the 1,512 others who are receiving high-signal, data-driven analysis to be in front of their peers in the cannabinoid space! If you have found value in our insights, please share this with another canna-curious individual to grow the revolution!

Each month we spend hours analyzing market research, data trends and private conservations to will keep you in front of the ever-evolving cannabinoid industry. Read the entire Report here

One Report, Once a Month, Everything you need to know

The article below is an excerpt from the Monthly Playbook.

Almost a century of cannabis prohibition has dramatically hindered scientific discovery and contributions to original knowledge about the effects and utilities of its botanical products. Academic science, which traditionally would have been expected to play an active role in this endeavor, has instead been limited by funding constraints and the study of NIDA-provided cannabis that does not represent what is available in the market. Currently, it is unreasonable to assume that such entities can pivot quickly and effectively.

There is a lack of any institutional knowledge base or understanding of the parallel, real-world advances now emerging from alternative community-based efforts as the tide turns towards widespread normalization and legalization of cannabis. Our non-profit (501c3) organization provides a compelling and complimentary alternative. We represent the ability to harness a more virtual and flexible collaborative approach to scientific advancement predicated on our team’s successful track record, as our members have been operating in the cannabis and cannabinoid science space for almost a decade and in the biotechnology industry and clinical arena across multiple decades. We have embraced an “act first, talk later” operating principle that has now led to a successful series of disruptive innovations in the cannabis science space.

How We Break Down The Cannabis Industry ’s Product Taxonomy

| CANNABIS INDUSTRY SEGMENT | Lifestyle | MEDICINAL: HEALTH & DISEASE | |||||

|---|---|---|---|---|---|---|---|

| Dietary Supp- lement |

Drug | ||||||

| MODE / ROUTE OF ADMINISTRATION | Inhaled | Ingested | Applied | Ingested | Inhaled | Ingested | Applied |

| CLASS OF STARTING MATERIAL | Hemp | ||||||

| Cannabis | |||||||

| PRODUCTION SCALE | Boutique / Artisinal / Craƒ | ||||||

| Commercial | |||||||

| Agricultural Commodity | |||||||

| PRODUCT GOAL | RBS | ||||||

| (Processed) Botanical Substance | |||||||

| Botanical Product | |||||||

| NDI API | |||||||

How we operate

As part of our intent to remain “meta”, the CESC is gaining acceptance and credibility as a neutral organization that performs product validations. Our position provides us with the foundation to accept grants and donations to carry out our initiatives and objectives. This, in turn, brings benefit to supply chain participants and to the greater community. We envision a validated product “formulary” that other industry participants and consumers can access. Our objective creates a reliable corpus of products to access for study or dependable use. Furthermore, we propose to identify products in this formulary by providing a certification mark that also communicates complex product content information in an easily understood format (the ChemoMark™).

Why we remain “meta”

As a nonprofit organization, the CESC positions itself as impartial and neutral to vested interests in the cannabinoid botanical industry. This permits our organization to develop best practices and guidance without being directed by special interests or stakeholders with private agendas. Our founders value their ability to contribute to original knowledge and anchor this with a long track record in bioscience and medicine. The CESC considers its non-profit status to be a general benefit to the cannabis industry as it establishes collaborations with private, for-profit industry participants and sponsors. We understand cannabis industry product taxonomy.

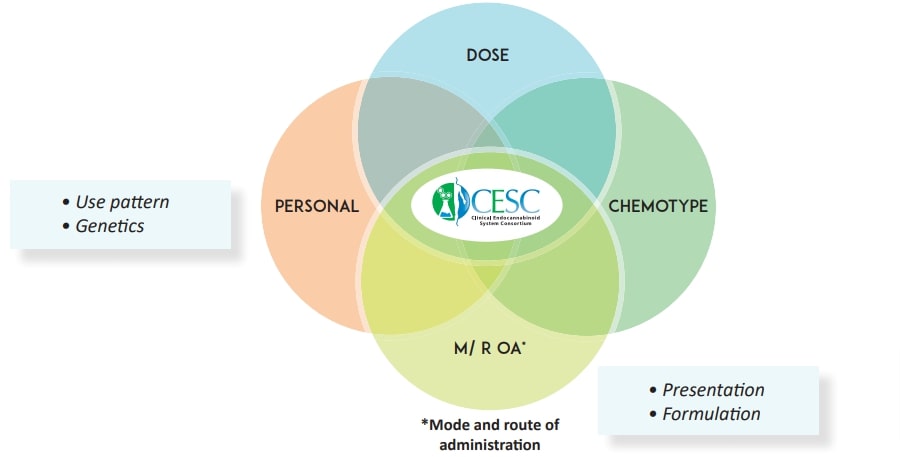

How we study the overlapping parameters, influencing effects & adverse events

Our Initiative

The CESC has established primary clinical programs that investigate the efficacy of cannabinoid botanical products. These clinical correlates initiatives center on The Dosing Project™, a Phase IV approach to clinical study. To complement a classical medicinal phased development program, we deploy a paradigm-shifting clinical study approach. The Dosing Project™ initiates our investigations by defining product dose-effect relationships for general neurophysiological indications, such as mood, sleep, pain, and appetite. Further clinical studies delve into evaluations of mood, concentration, and cognitive functioning using EEG and other biomarkers in a more traditional, phased-trial approach. We have also initiated clinical programs on the neuro-inflammatory processes affected by cannabinoid botanical products and their clinical effects on Alzheimer’s, autism, traumatic brain injuries, and nociceptive and neuropathic pain.

Our Focus

Our view is that the current regulatory climate surrounding the evolving acceptance and legalization of cannabinoid botanical products focuses primarily on aspects of product safety. Testing of such products involves determination of adulterants, including pesticides, heavy metals, residual solvents, and microbial bioburden. The CESC considers an investigation of adverse events (AE) to be an unmet product safety need for cannabinoid botanical products. This still leaves a big gap in the industry as far as determining product quality attributes. Such characteristics include chemotype, stability, and anticipated effects. From a producer perspective, understanding and appropriately exploiting such parameters helps with development decisions and offers opportunities for market segmentation and increases in market share. We therefore have positioned our investigations in this arena.

Our Study

Medicine development has long been the purview of white men. Historically, they provided the predominant manpower to advance these efforts. Additionally, white men provided the predominant group of subjects for clinical studies. We now understand the importance of stratifying such investigations to include women, different ethnic groups, and different age groups in order to better understand and fine tune the administration of medicines to individuals. This appreciation of study stratification has been in the DNA of the CESC since its founding. Incorporating gender, ethnicity, and age group into our ongoing studies of cannabinoid botanical products is integral and essential in our programs.