Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

UK member of Parliament said his medical cannabis bill “almost definitely” will not move forward due to a lack of support

Top German Government Official Previews Marijuana Legalization Plan Details

Costa Rica approves bill that allows the cultivation of Cannabis

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

Celebrity brands? Check. Direct-to-Consumer sales growth? Check. A newly heightened focus on ESG and DEI? Check. As these and other trends have grown in scale, attention, and money in the wider world, so they have as well in cannabis.

Non-fungible tokens or NFTs are no exception.

At this point, it’s hard to avoid the hype and attention NFTs have received these last twelve months. 2021 will be remembered for the year NFTs broke into mainstream consciousness.

And of course, there is the money flowing into the space –

What are NFTs?

NFTs are a technology tied in with the broader crypto ecosystem that includes blockchain technology, cryptocurrency assets like bitcoin and Ethereum and decentralized autonomous organizations (DAOs).

And of course, there is the money flowing into the space –

At its core NFTs are unique units of data that use technology to allow digital content – songs, videos, images – to be logged and authenticated on cryptocurrency blockchains like Ethereum and Solana. Once content is logged on the blockchain, every transaction from sales to transfers is recorded ‘on-chain’ creating a transparent and trackable ledger of provenance and price history. Contracts can also be written into the code of the digital content which shape the rules around how the content is utilized. The main impact of NFTs is making it easier for creators to own, sell and control the rights to digital content.

NFTs and cannabis industry.

The first most obvious use case for NFTs in cannabis is artwork showcasing specific cannabis strains or products. NFT’s offer another pathway to creating the first global brand in the industry. But due to the global nature of NFTs and national regulations on marketing and advertising, the opportunity is not clearcut.

Dan Sutton, CEO of Tantulus Labs and a longtime crypto enthusiast believes it’s still very early in the NFT Cannabis adoption cycle, “It is still too early to point to any material value creation case studies integrating cannabis with NFTs. Currently cannabis projects in NFTs have been focused on collectible art and play-to-earn (P2E) gaming.”

“Long-term application of NFTs in cannabis will probably be slower than CPG company analogs, due to the complex regulation of cannabis across diverse jurisdictions. NFT audiences are inherently global, so any concept that revolves around redeeming an NFT for cannabis products seems more complex to me than other CPG categories. Attaching an NFT to a cannabis marketing campaign in Canada for instance, would be close to impossible.”

One project Dan is active with is WeedgangNFT.com. Artists are working in collaboration with master growers to feature famous cannabis strains and potentially create new strains both virtually and in the real world. An NFT strain generator, currently under development, will iterate traits like color and bud size, incentivizing breeding knowledge and game theory. Cannabis aficionados can buy an NFT artwork of their favorite strain or from their favorite master grower through digital tokens unique to the project and join a community in ownership of the strain NFTs and collaborate to bring virtually generated strains into reality.

Another Cannabis NFT pioneer is Oaksterdam University. Oaksterdam offers a range of cannabis-focused education and certifications for aspiring cannabis professionals and entrepreneurs. Last year they launched a contest for artists to create two-sided trading card style NFTs with narration to raise awareness and funds for fighting the 50 year-long War on Drugs. Bids on the NFTs started at $420.

“Where it gets interesting is the cultural crossover between the small and early NFT audience and cannabis” continues Sutton. “We read a lot of headlines about NFTs, but only a few hundred thousand unique wallets hold them globally today. Many prominent leaders in the NFT world outspokenly consume cannabis, and the potential for conference, event, and IRL activation crossover could be valuable medium term as this audience grows.

NFTs are at the very earliest stage of the adoption curve. Many projects will never materialize or fail to live up to the hype and high valuations and Cannabis-specific regulation may be too large a barrier to overcome. The next few years will be critical in determining how important or not NFTs are within the crypto and cannabis industry. Most NFT cannabis projects are still in the lab being developed. Expect to see several major consumer-facing US cannabis brands launch or announce NFT major projects in the space in 2022.

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

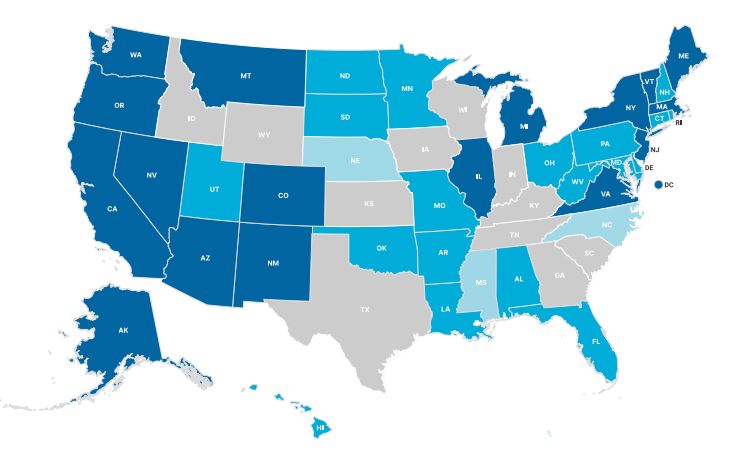

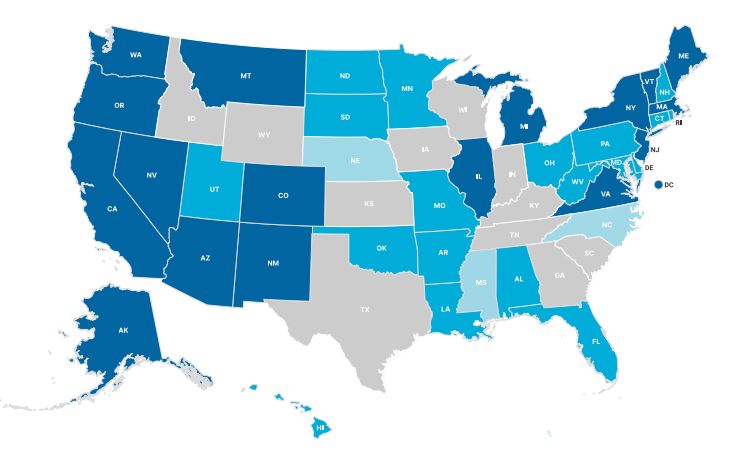

While cannabis has achieved legal status in many states, the opening of public spaces for consumers to enjoy local cannabis products are few and far between. In the U.S., excitement surrounding consumption lounges and cannabis tourism is hampered by significant economic and legal barriers. Yet as legal and public opinions evolve, cannabis business owners express hope that the U.S. cannabis industry will shift to prioritize the quantity, safety, and accessibility of its consumption lounges.

West Hollywood (WeHo) is one of few U.S. cities wholeheartedly invested in the future of consumption lounges. The Artist Tree Marijuana Dispensary is one of six dispensaries currently registered in WeHo: Kelly Lyon of The Artist Tree has witnessed the real-time transformation of the city into a cannabis powerhouse, with cannabis business owners using the Amsterdam model to design a forthcoming array of pot cafes, restaurants, lounges, and galleries. Major celebrities have already invested in the city’s cannabis industry, including Jay-Z. The city’s Community and Legislative Affairs Manager, John Leonard, states that the city could soon have up to 23 cannabis businesses, allowing customers to engage in everyday activities such as yoga classes or gallery walks – while consuming their favorite cannabis products.

prime example: although the state legalized cannabis over five years ago, consumers have yet to enjoy cannabis in a state-sanctioned lounge. Potential openings hang in legal limbo as lawmakers discuss reforms to local marijuana agreements. Inaction from the Legislature exacerbates the issue,

and local licensing corruption prevents small business owners from competing in a state market increasingly saturated with big companies. To protect both small business owners and consumers, cannabis professionals have urged the state to reduce the costs of selling cannabis products and support the entry of small, minority-owned cannabis business owners into the market.

Whether located in Nevada, Massachusetts, or California, consumption lounges will introduce innovative cannabis products to new customers, alleviate odor issues, and promote overall public health and enjoyment of recreational marijuana. By addressing certain legal and financial barriers, local cannabis business owners will be empowered to operate consumption lounges legally and confidently, increasing public venues for consumers to integrate the myriad benefits of cannabis into their daily lives.

Industry growth in WeHo is reinforced by overwhelming local support for Proposition 64, which legalizes cannabis and social spaces for its consumption, regulated by strict odor- and alcohol-related rules.

These and other regulations, while vital to the safety and public reception of consumption lounges, have slowed the rollout of consumption lounges in other states. Massachusetts serves as a

To better support smaller businesses and invest in the potential of cannabis lounges, Nevada – and more specifically, Las Vegas – is focused on social equity applicants, broadly defined as businesses owned by people adversely affected by the criminalization of cannabis. In addition to existing Nevada dispensaries, which will be eligible to apply for a single consumption lounge license, the state’s cannabis regulators can also issue up to 20 independent cannabis lounge licenses before July 2022 – at least half of which must go to social equity applicants. Clark County, NV plans to start a fund from its municipal marijuana revenue to ensure that equity applicants can meet the lofty financial requirements of running consumption lounges and other cannabis businesses. Because Nevada law only allows consumption lounges to sell single-serving products, some worry that customers will over-consume in the celebratory atmosphere of a Sin City lounge. However, leaders in the cannabis beverage space, such as Chelsea Bedard of CANN, view serving caps as an opportunity to introduce new customers to the controlled experience of micro-dosed cannabis beverages before experimenting with other products.

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

Adding to the complexities of cannabis regulation, today’s cannabis business owners face the challenge of marketing their products to a growing and diverse customer base. Current trends in the cannabis vapor pen niche offer key insights into successful cannabis marketing, wherein customers are empowered to select products that align with their values and goals for recreational marijuana use.

Compared to other cannabis product categories, customers who regularly purchase cannabis vapor pens express more loyalty for a single brand, according to a December Headset review of cannabis brand loyalty based on the purchase patterns of California consumers in a pre-period (August 2020 to April 2021) and post-period (February to July 2021). Noting that cannabis

variable of consideration illustrates that high brand loyalty is not always the goal. Consider the vapor pen brand Legion of Bloom: because the brand fills Pax pods, their customers often switch with other brands that also fill Pax pods. Legion of Bloom customers tend to be loyal to their Pax batteries, but not necessarily to the brand filling the pod: therefore, filling Pax pods might result in lower brand loyalty to Legion of Bloom, but strategically open up the brand up to a larger pool of consumers seeking Pax batteries. Analyzing these switches can help brand managers determine other brands and products that serve as quality substitutes for their brand, helping them improve and expand their product portfolio.

While cannabis brand managers should consider these consumer behaviors when strategizing their customer base and marketing plans, Philip Wolf, CEO of the culinary cannabis company Cultivating Spirits, implores brand managers to prioritize the intention and conscious consumption of cannabis products. Because the individual effects of cannabis vary greatly, Wolf argues that cannabis companies should empower customers to develop a constructive relationship with cannabis: one that honors the nuanced effects of the plant and provides customers a rich experience.

vapor pen consumers tend to exhibit high brand loyalty, cannabis businesses can learn how to assess brand loyalty by examining three consumer variables. The first, repeat purchase rate, references the percentage of customers that continually repurchase from a single

brand. CA data suggests that vapor pen brands have fairly high brand loyalty: 32.6% of customers will repeat the brand purchase along with other brands, while 12.6% only purchase from a particular brand. Wallet share, or how much customers spend on a given brand, is another key indicator of brand loyalty: among CA vapor pen customers, brand loyalty again skewed high, with the average customer spending nearly 40% of their wallet on their top vapor pen brand.

Analysis of switching behaviors, our third

Industry data from Headset and other analysts is essential for cannabis marketers; nevertheless, companies must remember that consumers are individuals with unique usage behaviors that may fluctuate more than aggregate data suggests. Particularly for cannabis vapor pens, which have been subject to legal scrutiny and health concerns, it is vital that cannabis companies commit to education about vapor pens and consider related product niches to empower a growing customer base.

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go