Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

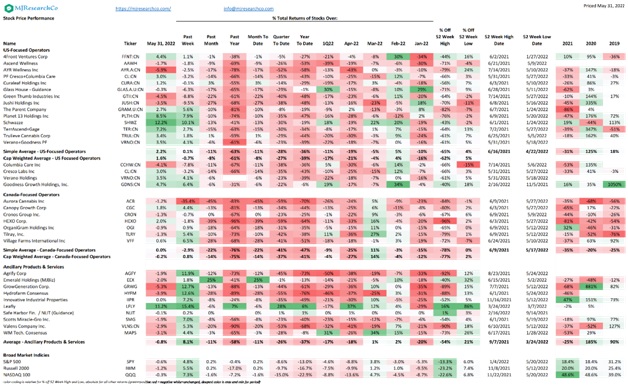

From March 31 to May 31, the US plant touching operators on my comp table taking the sums on 2022:

What does this all mean for cannabis? The key questions are:

Are reductions to EBITDA estimates finished? While the valuations are low, continued cuts to estimates that were too-aggressive last year make multiple expansion difficult. Margin expectations are still robust at 27% for the publics overall, but there is a range here from 23% to 38%. But with low multiples on reduced estimates, meeting or beating those estimates in 2Q results reported in August would generally lead to rapid multiple expansion.

How long can those mid to high 30s margins last? While shorter term investors focus on margin expansion and contraction as this can drive multiples higher, longer term equity investors ultimately focus on the free cash generated, and that is driven by the profit dollars, not percentages – as the old saying goes “you can’t eat margin”. A 25% margin on $1 billion of revenue ($250 million of profit) is larger and ultimately preferable to a 35% margin on $500 million ($175 million).

Shift to Cyclical from Growth investors: Though multiples are low, the industry generally needs a shift in the investor base from those view these like tech names for “fast growth at any cost” and higher multiples, to investors more used to cyclical names like consumer and industrials. These investors typically focus on the drivers of growth (organic vs acquisitions, price vs volume), incremental margins and incremental dollars, and can look through lower prices to also see higher volumes, and lower total margins amidst higher profit dollars.

Is Legal Cannabis a consumer defensive if the economy enters a recession, or is it consumer discretionary? So far there has been little experience with legal cannabis in markets amidst a recession. Alcohol profits have historically done fine in recessions, but there can be trade down to cheaper versions of products. Cannabis has the unique competitor of the unlicensed market, which is typically cheaper. Investors must remember that while cannabis may be recession resistant, purchases of legal cannabis can shift back to the unlicensed market.

MJResearchCo conducts rigorous investment analysis of the legal cannabis industry to help professional allocators of capital make better investment decisions.

To learn more visit https://mjresearchco.com/

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

Nowadays, it’s tough to be a cannabis operator. Wholesale prices are crashing, there are increasing levels of competition, an ever-changing regulatory landscape, an unfavorable and unsafe tax regime, and a dozen other major thorns on your side. And now we appear to be in or headed towards a global economic recession some macroeconomic analysts are predicting to be quite severe and long-lasting. Inflation, supply chain breakdowns, higher interest rates, low economic growth, and high unemployment are either on the horizon or are already in place..

Is the cannabis market going to make it? Am I going to make it? These are common questions of those in the industry.

While the effects, length or severity of a recession are anyone’s guess, there is a silver lining that many other industries can’t rely on. New marketing and new customers are coming into the cannabis market regardless of an economic downturn.

Multi-billion-dollar markets are opening on the East Coast: New York, Connecticut and New Jersey are coming online with much pent–up growth. Regardless of the severity of the economic downturn – the size and strength of the cannabis market will continue to grow.

Will we get something positive out of DC in 2022? Maybe.It’s always hard and often frustrating to predict positive cannabis legislation passing federally. Pressure and momentum continues to grow on SAFE Banking Act or similar omnibus legislation that falls short of federal legalization passing this year. If passage does occur it will act as a massive stimulus to the entire industry; lowering operating costs and opening up new flows of capital and financial opportunities currently unavailable due to federal legal restrictions.

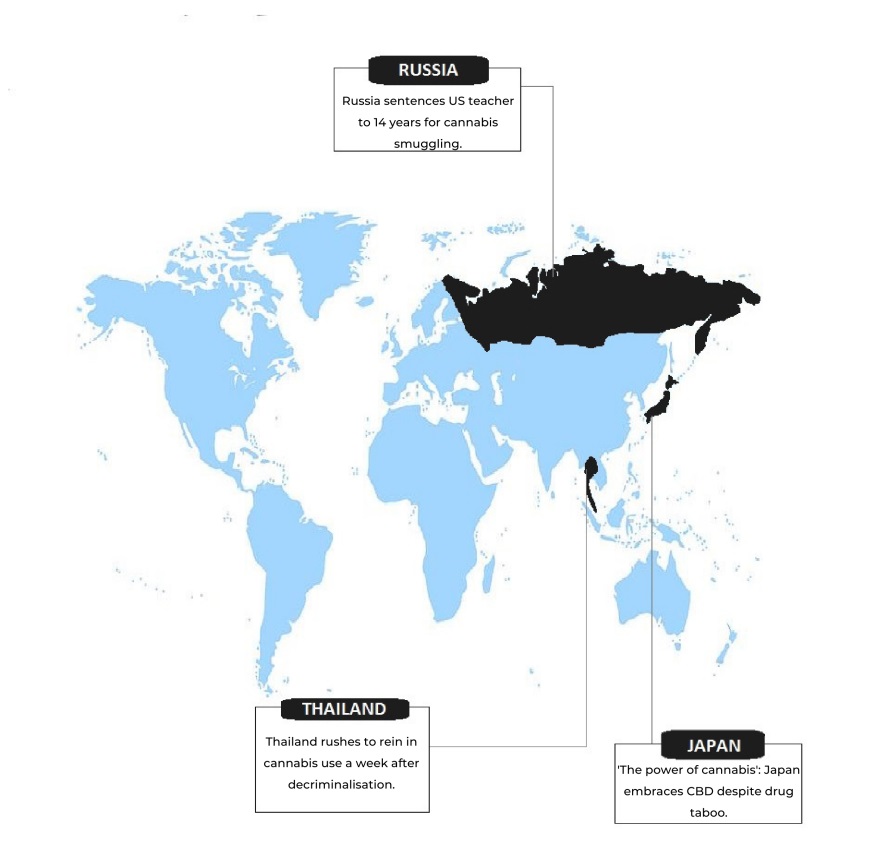

States are continuing to act and move forward, here are some highlights:

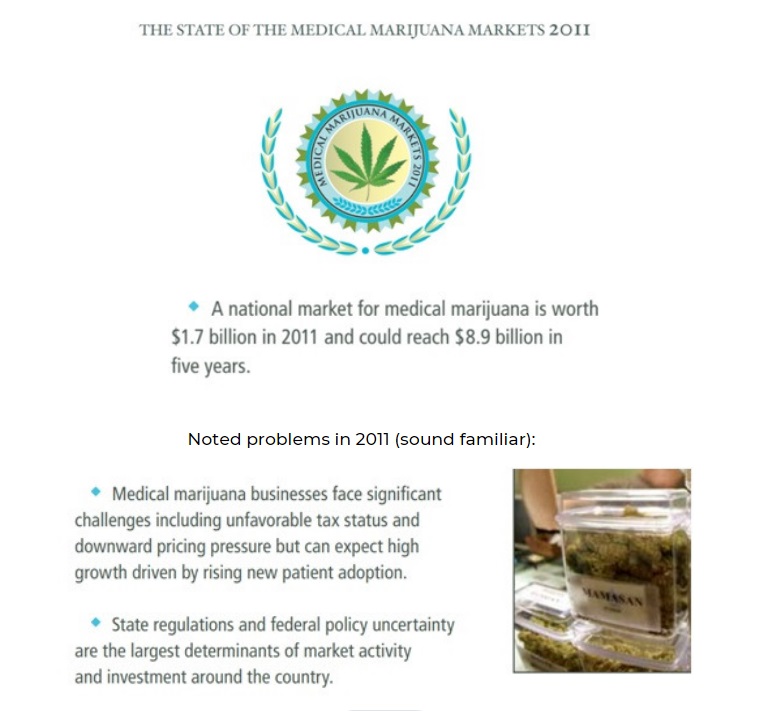

Also don’t forget where we’ve come from. In 2011 the Arcview Group released a first of its kind report on the State of the Legal Cannabis Market in North America –

Historically, it’s never been easy to operate in this space.

This was only 10 years ago. Going from $1.7 to $24 billion in total sales in a decade is impressive in anyone’s book, and we know 2022’s total market size will be bigger still. What can we realistically imagine the cannabis industry will look like 10 years from now in 2032?

In short, a dramatically different US and global cannabis environment will exist. Take the long view on the cannabis industry and you can only be optimistic. What can you contribute to make this dream a reality in your own business, your own cannabis dreams, your own positive cannabis advocacy?

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

What Disconnect?

Cannabis products are sold from coast to coast. However, it is increasingly clear that the consumer community is not happy.

Cannabis has already become a multi-billion-dollar industry. Cannabis products are sold from coast to coast. However, it is increasingly clear that the consumer community is not happy, and many are leaving the regulated market because they experience Inferior products. These products are perceived as too expensive and burdened by excessive tax rates. Efforts to apply national standards are still in discussion, while the Cannabis industry is mired in a patchwork of state-by-state safety regulations and a lack of interstate commerce. The Cannabis consuming public deserves a solution.

As co-founder of the CESC, a nonprofit Cannabis Science organization, Dr. Jean Talleyrand, M.D. recently visited the Flore Dispensary in San Francisco’s Castro District.Flore Dispensary is a newly opened medical Cannabis retail store located at a historic corner. At this corner more than 25 years ago, Brownie Mary handed out Cannabis infused “treats” to AIDS patients. Just down the street, Dennis Peron’s Cannabis Buyers Club became the world’s first medical Cannabis dispensary since prohibition. A few years later, Dr. Talleyrand evaluated his first medical Cannabis patients, also down the street. Dr. Talleyrand now represents a pressing need for the scientific exploration of Cannabis products. The CESC is coordinating a launch of Version 2 of The Dosing Project with the Flore Dispensary. The Dosing Project investigates community-accessible Cannabis products to discover optimal doses and efficacy. What better venue than this: a historic community that provides a natural resource for research? The Flore Dispensary along with other CESC strategic partners are the proving grounds for this CESC initiative.

“The Cannabis community is thirsty for knowledge. They are curious to know what and how much works for their aches, pains, and stressors. They want to know what gives energy or relaxes them. What makes them hungry, sleepy, or (yes, even) aroused”

Dr. Jean Talleyrand, Chief Medical Officer of the CESC

How have we landed in the present situation: a largely unmet need for Cannabis product surveillance for both safety and efficacy for consumers?

At a recent (June 14, 2022) meeting of the FDA, after soliciting public comment it was clear that consumers expect regulators not to prohibit, but to monitor Cannabis product efficacy, safety, and content.

There are elements of regulatory disconnect at all levels of the Cannabis industry. Federal and state regulatory agencies are addressing limited parts of the challenges presented by Cannabis. Because the FDA has approved THC and CBD as pharmaceutical ingredients, it sets up a regulatory conflict with Cannabis products. The pathway for seeking regulatory approval and oversight for food and dietary supplements incorporating cannabinoids is opaque. This results from a basic tenant of the FDA that pharmaceutical ingredients cannot be food additives or supplements. Regulatory oversight at the state level has largely focused on product safety, eschewing the question of product efficacy, and leaving that to the commercial industry and marketplace to sort out for itself. Commercial organizations, however, are barely able to focus on evaluating their product efficacy. After being overwhelmed by high state and local taxation rates, and the vagaries of getting and keeping a bank account in the current banking environment, Cannabis product manufacturers are left with few resources to devote to research and development. As a result, the consumer is left in the dark and unsure how to make good purchasing decisions.

The CESC’s Solution: Establish a Cannabis product ecosystem. The CESC is building a product formulary comprising a validated set of Cannabis products that consumers can rely on. Furthermore, the CESC is developing an application that predicts dose and outcomes from products across all categories. This model is anchored to community assessments derived from the Dosing Project and powered using AI, machine learning algorithms engineered by top-tier Cannabis data science professionals.

Over the next five issues of The Cannabinoid Playbook, we will illustrate the conceptual foundation and provide the details how the CESC solves this disconnect between Cannabis industry growth potential and current consumer dissatisfaction.

I. A Paradigm Shift: Introducing the Dosing Project as a broad observational study platform providing a non-traditional approach to clinical study

II. Solving the “Sativa” or “Indica” dilemma: Cannabis aroma provides a foundation for classification

III. Beyond Cannabinoids: How Cannabis terpene, thiol, and ester components can expand product classification

IV. Validating characteristic anticipated effects of Cannabis use and categorizing responders

V. Evaluating Cannabis products

For further information, please contact The CESC at [email protected] at the end in the available white space at the bottom of the 2nd page. Also, can we add a link to our website in this sasme space. Visit The CESC

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go

[00:07:02] Vince Ning on Nabis’ earliest business plan

It comes back to just what the customer needs. And back then, we didn’t have our B2B marketplace. We didn’t build a Nabis Capital Solution. We didn’t build analytics tools. We just built a website to help people enter orders in that we would deliver and fulfill. We’d collect payments for them and that’s what people needed. They didn’t need some fancy software, they didn’t need AI. They just needed some way to deliver their products from point A to point B compliantly and get paid. We would do the deliveries ourselves just to give that sort of high-touch experience and build a relationship directly with the execs at these companies. They just needed more tools that help them at scale, so that’s how we started to build out and flesh out the rest of our platform, and that’s what currently exists today.

[00:17:45] On the challenges that face some of the California cannabis operators

I’ll say that the biggest challenge right now is just incredibly high taxes. The problem is it’s actually starting at the top of the supply chain with cultivators. Ever since the inception of the California market, there’s been a cultivation tax. An excise tax and cultivation taxes were charged based upon the weight of the flower that was produced.

After last year, there’s been this overproduction, oversupply, of flower that are coming into the world. The average price per pound has fallen significantly, but the weight is still the same, if not more. What ends up happening is the taxes don’t fall in line with the average price per pound.

Because you’re still paying the same taxes but making less money, we’ve heard cultivators saying that they’re paying up to about 40% of what they have as their revenue in cultivation tax alone, not to mention all the labor costs and the actual cost to produce this product.

[In the legal cannabis industry] what operators will have to do is increase pricing to make their ends meet and who ends up bearing the cost is actually the consumer. And so when the consumer goes and buys weed, they will choose to buy from the illicit market because there are no taxes being applied to their own [production] and costs, and it’s oftentimes the same quality product.

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.

Action-Oriented problem solvers ready to go