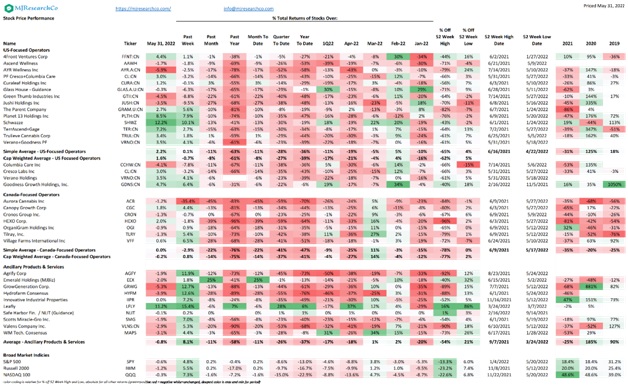

From March 31 to May 31, the US plant touching operators on my comp table taking the sums on 2022:

- The stocks are down an average of 28% since March 31, while the NASDQ 100 (growthy tech) dropped 15%, and the Russell 2000 (small cap) dropped 10% and S&P500 (large cap) dropped 9%.

- The Canadian LPs are down 41% since March 31 and 22% in May; the average Canadian LP is trading at 3.9X sales. Remember that I do not deduct the net cash balances since the capital is being invested and FCF is negative, so my Canadian operators look more expensive. Though Cronos has a $1.1 billion market cap and $981 million of cash, I doubt that cash will ever be directly returned to equity holders via dividends or buybacks rather than used to fund losses and acquisitions of assets.

What does this all mean for cannabis? The key questions are:

Are reductions to EBITDA estimates finished? While the valuations are low, continued cuts to estimates that were too-aggressive last year make multiple expansion difficult. Margin expectations are still robust at 27% for the publics overall, but there is a range here from 23% to 38%. But with low multiples on reduced estimates, meeting or beating those estimates in 2Q results reported in August would generally lead to rapid multiple expansion.

How long can those mid to high 30s margins last? While shorter term investors focus on margin expansion and contraction as this can drive multiples higher, longer term equity investors ultimately focus on the free cash generated, and that is driven by the profit dollars, not percentages – as the old saying goes “you can’t eat margin”. A 25% margin on $1 billion of revenue ($250 million of profit) is larger and ultimately preferable to a 35% margin on $500 million ($175 million).

Shift to Cyclical from Growth investors: Though multiples are low, the industry generally needs a shift in the investor base from those view these like tech names for “fast growth at any cost” and higher multiples, to investors more used to cyclical names like consumer and industrials. These investors typically focus on the drivers of growth (organic vs acquisitions, price vs volume), incremental margins and incremental dollars, and can look through lower prices to also see higher volumes, and lower total margins amidst higher profit dollars.

Is Legal Cannabis a consumer defensive if the economy enters a recession, or is it consumer discretionary? So far there has been little experience with legal cannabis in markets amidst a recession. Alcohol profits have historically done fine in recessions, but there can be trade down to cheaper versions of products. Cannabis has the unique competitor of the unlicensed market, which is typically cheaper. Investors must remember that while cannabis may be recession resistant, purchases of legal cannabis can shift back to the unlicensed market.

MJResearchCo conducts rigorous investment analysis of the legal cannabis industry to help professional allocators of capital make better investment decisions.

To learn more visit https://mjresearchco.com/

Editors’ Note: This is an excerpt from our Monthly Playbook. If you would like to read the full monthly playbook and join the thousands of others you can sign up below.